-

Nigeria: Nigeria's Unbanked, Poor Get Reprieve After Court Rules Naira Deadline Unconstitutional

IPS, 6 March 2023

Nigerians confronted by hardships over the scarcity of the newly redesigned naira notes in conjunction with the country's cashless policy introduced by the apex bank have had a… Read more »

-

Nigeria: Supreme Court Extends Old Naira Notes Validity Till December

Premium Times, 3 March 2023

A seven-member panel of the Supreme Court led by John Okoro unanimously directed that the CBN must continue to receive the old notes from Nigerians. Read more »

-

Nigeria: Timeline - Naira Redesign Policy From Inception to Supreme Court Judgement

Premium Times, 2 March 2023

Here is the timeline of major developments concerning the naira redesign policy since its inception up to Friday when the Supreme Court is expected to give its judgement. Read more »

-

Nigeria: Buhari Apologises Over Naira Redesign Policy

Vanguard, 3 March 2023

Apparently disturbed by the performance of the ruling All Progressives Congress, APC, in the just concluded presidential and National Assembly election in Kaduna State, President… Read more »

-

Nigeria: Old Naira Notes Remain Legal Tender Till Dec 31 - Supreme Court

Vanguard, 3 March 2023

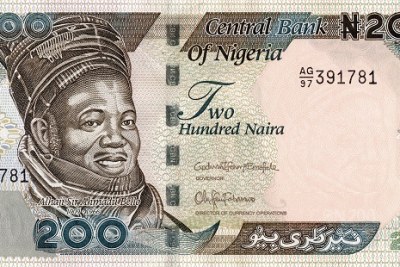

The Supreme Court, on Friday, nullified the ban on use of the old N200, N500 and N1000 banknotes as legal tenders. Read more »

Validity of Nigeria's Old Naira Notes Extended to December 2023

Nigeria's Supreme Court has ruled that old banknotes remain legal tender until the end of the year, bringing relief to millions affected by a chaotic redesign of the naira notes.

The court held that the directive of President Muhammadu Buhari for the redesign of the new notes and the withdrawal of the old notes without due consultation, is invalid. Buhari directed the central bank to release old 200 naira banknotes back into circulation, to run concurrently with the new ones until April 10, 2023. However, he said that old 500 and 1,000 naira banknotes are no longer valid and must be taken to the central bank through designated channels. Many people were unable to get cash to pay for food and slept outside banks.

A January 31 deadline initially set for ending the legal tender status of the old Naira notes was extended to February 10, as the supply of the new notes fell far short of the volume needed by citizens to meet their most basic needs across the country.

On February 3, three state governments - Kaduna, Kogi, and Zamfara - citing the hardships the continued scarcity of naira notes brought to their people - sued the federal government at the Supreme Court for a reversal of the policy. The court issued an interim order suspending the implementation of the deadline set by the federal government and directed that the old and new Naira notes should continue to circulate pending the resolution of the case.

In November 2022, the Central Bank of Nigeria (CBN) launched new banknotes that came into circulation on December 15, 2022. The CBN said the redesign was meant to address insecurity, tackle counterfeiting and force excess cash back into the banking system.

InFocus

-

President Muhammadu Buhari has directed the country's central bank to release old 200 naira banknotes back into circulation, to run concurrently with the new ones until April 10, ... Read more »

-

The Supreme Court has temporarily suspended the February 10, 2023 deadline to stop the use of old banknotes, which had caused a cash crisis in the country. Banks have not ... Read more »

-

Nigeria has introduced into circulation its new currency in the first such redesign in 20 years. The authorities say the measure is meant to address insecurity, tackle ... Read more »