-

Kenya: Millions Indebted to Mobile App Lenders

DW, 17 April 2023

Loans through mobile apps have skyrocketed in Kenya. While this fintech industry provides easy-to-access credits, it has become a nightmare. Experts fear the largely unregulated… Read more »

-

Kenya: Google Removes Kenyan Loan Apps From the Play Store for Lacking CBK Licenses

Capital FM, 27 March 2023

Google has removed Kenya loan apps from the Play Store as it cracks down on unregistered lenders. Read more »

-

Kenya: Kenyan Digital Lenders Disbursed U.S.$4 Billion in 8 Years

Capital FM, 15 March 2023

Digital lenders have disbursed a total of Sh500 billion in mobile loans to households and small businesses. 3,852,080,100 Read more »

-

Kenya: Digital Lenders in Kenya Must Disclose Source of Funds as New Law Takes Effect

TechCrunch, 24 March 2022

Digital credit providers (DCPs) in Kenya will have to disclose their sources of funds and provide evidence of the same following the coming into force of a law meant to regulate… Read more »

-

Kenya: Digital Lenders Barred From Accessing Customers Contacts Under New Law

Capital FM, 21 March 2022

Digital lenders will now be barred from accessing customers' contact lists in the course of debt collection under new CBK regulations. Read more »

Millions of Kenyans Indebted to Mobile App Lenders

Loans through mobile apps have skyrocketed in Kenya. While this fintech industry provides easy-to-access credit, it has become a nightmare. Experts fear the largely unregulated market could lead to a credit crisis, reports Chrispin Mwakideu for Deutsche Welle.

A recent government survey reveals that more than 80% of Kenya's adult population uses mobile money providers. And according to a financial technology (fintech) research institute, FSD Kenya, the number of digital lenders and loans disbursed grew substantially after the launch of M-Shwari in 2012. M-Shwari is a Safaricom savings and loan service that enables M-PESA customers to save and access loans.

Before this fintech boom, Kenyans used traditional bank loans and an informal credit system known as Sacco (savings and credit corporations).

The easy-to-access credit industry that exploded with the tech boom now faces considerable criticism, with concerns ranging from debt-collecting methods to additional charges.

InFocus

-

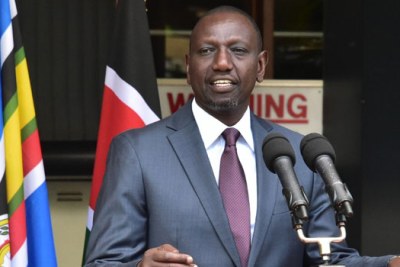

President William Ruto has said that 800,000 Hustler Fund loan borrowers have defaulted on their repayments, Njoki Kihiu reports for Capital FM. The president is urging borrowers ... Read more »

-

President William Ruto said he was keen on confronting hunger and insecurity and turn Kenya into an equal-opportunity country for all. Among the changes the presi Read more »

-

Education Cabinet Secretary, Ezekiel Machogu, has told Kenya National Union of Teachers (KNUT) to be considerate with the current economy, while asking for the implementation Read more »

-

Concerns have been raised that the dollar shortage in the country could trigger job losses as more manufacturing firms may be forced to shut down or suspend operations as the Read more »

-

President Uhuru Kenyatta has urged the next administration to use debt - emphasising its importance - as a key accelerator of economic development. Kenyatta, whil Read more »